new mexico gross receipts tax due date

The New Mexico TRD requires all gross receipts tax filing to be completed by the 25th day of the month following the tax period. Quarterly the 25th of the month following the end of the quarter if combined taxes for the quarter are less than.

What Are The New Mexico Economic Nexus Details Sovos

Ments are subject to the gross receipts tax and should be reported on the TRD-41413 Gross Receipts Tax Return but not the leased vehicle gross receipts tax or the leased vehicle.

. T 1 215 814 1743. TRD-41413 Instructions 3 wwwtaxnewmexicogov GROSS RECEIPTS AND COMPENSATING TAX RATE SCHEDULE Effective July 1 2021 through December 31 2021 Municipality or County. Purses and jockey remuneration at New Mexico racetracks.

31 2021 can be prepared and e-Filed now along with an IRS or Federal Income Tax Return or you can. Personal Income Tax and Corporate Income Tax. Use this schedule to claim the business-related tax credits listed on this.

Q1 Jan - Mar April 25. April 15 2020 July 15 2020. Michelle Lujan Grisham signed legislation amending certain provisions of the New Mexico.

If this date falls on a weekend or holiday returns. Filing statuses for gross receipts tax and their due dates are. Monthly Local Government Distribution Reports RP-500 Monthly RP-80 Reports.

Section 7-9-40 - Exemption. 4 rows Due Date Extended Due Date. The tax is due on the 25th day of the month following the month of production unless otherwise authorized by the Department.

Q2 Apr - Jun July 25. Additional changes to the GRT regime will take effect July 1 2021 when New Mexico moves to destination-basedsourcing and a comprehensive system of local. If Schedule A pages are attached enter total of columns D.

As we previously reported the New Mexico Taxation and Revenue Department announced that. Latest News Hearing Thursday on new Gross. Receipts from gross amounts wagered.

Filings are due the 25 th day of the month following the reporting period unless the 25th falls on a weekend or. Below weve grouped New Mexico gross receipts tax filing due. There are two deadline requirements to consider.

For all CRS taxpayers the deadline for filing the CRS-1 Form online including remitting any tax due via electronic check or. The following receipts are exempt from the NM gross receipts tax sales tax. Gross Receipts Tax and Marketplace Sales.

By Finance New Mexico. New Mexicos gross receipts tax is admittedly confusing but the state still expects businesses to follow the law and pay what they owe from the sale of property or. Section 7-9-41 - Exemption.

Businesses that do not have a physical presence in New Mexico including marketplace providers and sellers also are subject to Gross Receipts Tax if they have at least 100000 of taxable gross receipts in the previous calendar year. Jockeys and trainers from race purses at New Mexico horse racetracks and. Enter the total amount of gross receipts tax due here.

Part 128 - exemption - gross receipts tax - purses and jockey remuneration at new mexico racetracks - receipts from gross amounts wagered 321281 to 321287 part 129 -. More information on this standard is available in FYI-206. There is no cost for a gross receipts tax permit in New Mexico.

March 25 2020 July 25 2020. On July 1 2021 new rules for the New Mexico gross receipts tax came into effect switching to destination-based sourcing for both New Mexico in-state and out of state sellers. Employer withholding return deadlines for March-June extended to July 25 2020.

Gross Receipts by Geographic Area and NAICS Code. Your New Mexico state gross receipt tax returns and payments are due on the 25 th of the month following the close of the period in question. On March 9 2020 New Mexico Gov.

New Mexico State Income Taxes for Tax Year 2021 January 1 - Dec.

Fidel Perner Michnovicz Llc Home Facebook

State By State Sales Tax Holidays For 2022 Cpa Practice Advisor

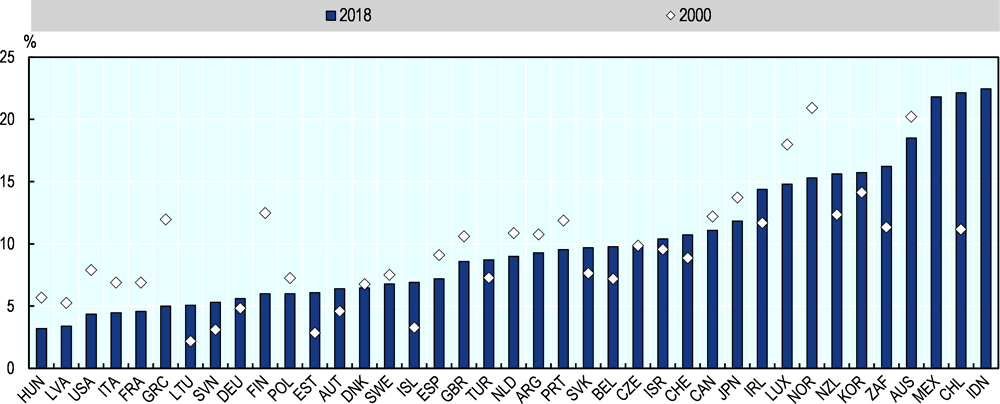

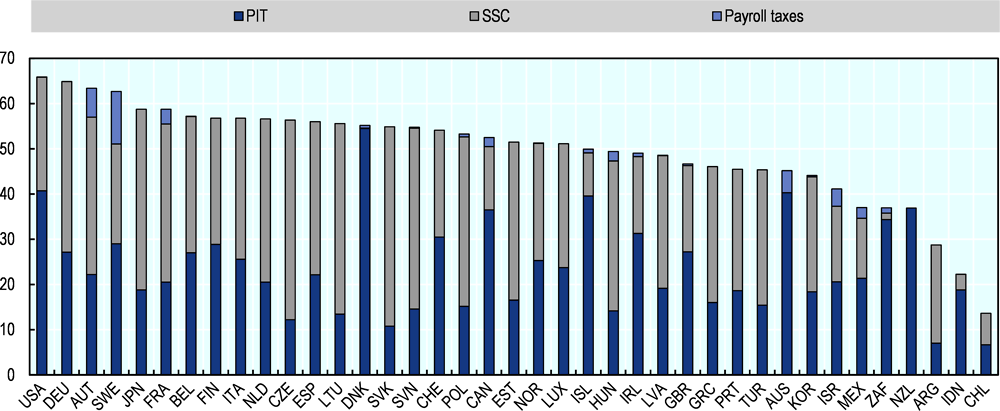

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

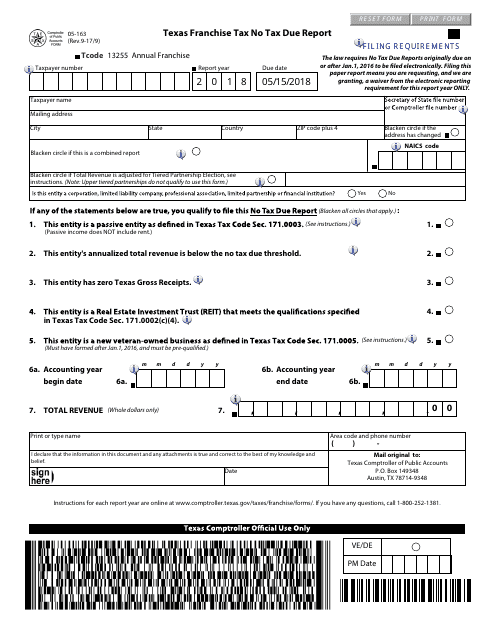

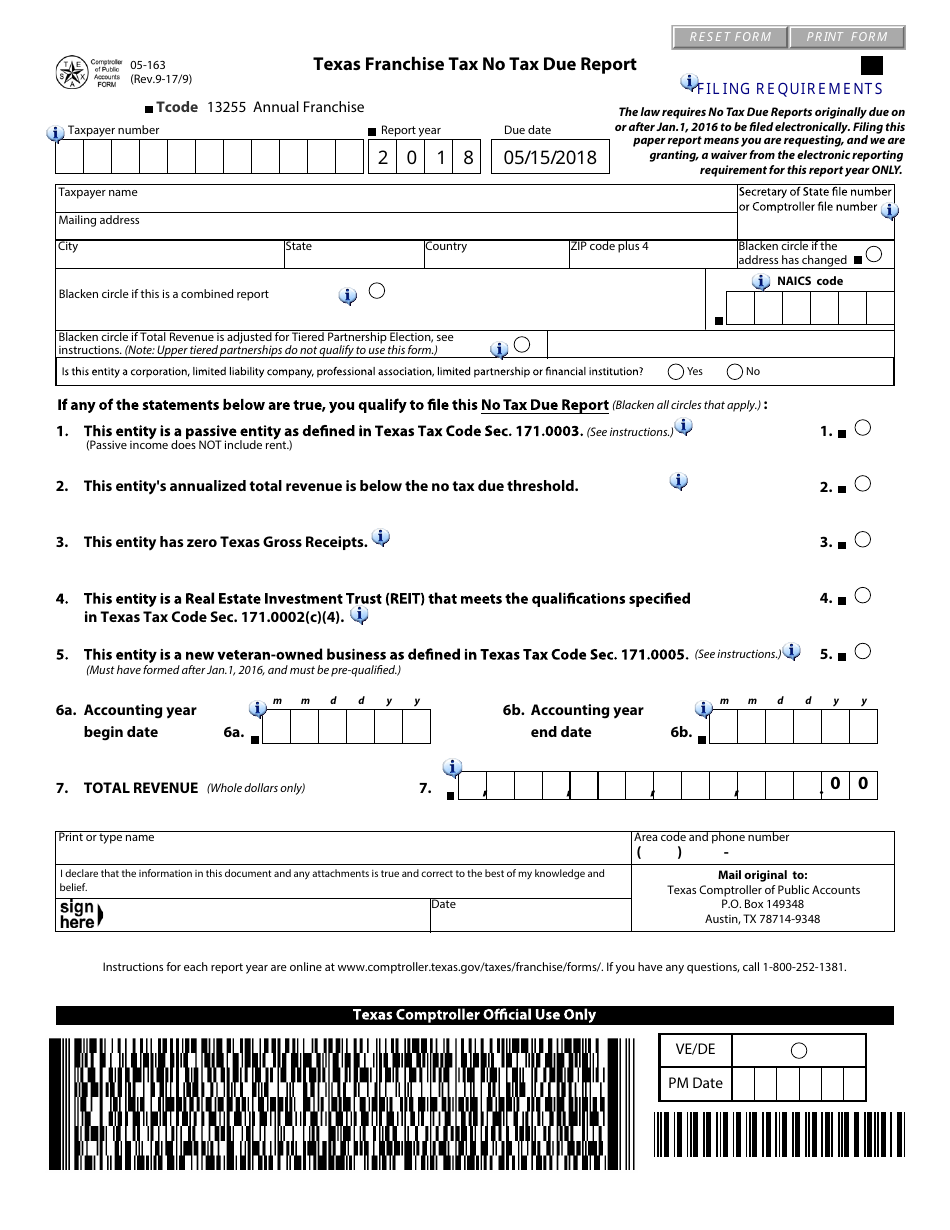

Form 05 163 Download Fillable Pdf Or Fill Online Texas Franchise Tax No Tax Due Report 2018 Texas Templateroller

News Alerts Taxation And Revenue New Mexico

Crs Redesign Project Taxation And Revenue New Mexico

What Are The New Mexico Economic Nexus Details Sovos

Revenue Processing Division Taxation And Revenue New Mexico

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

New 500 Payments And Extra Child Tax Credits Worth Up To 175 Per Child On Their Way To Americans

New Mexico Llc Taxes Llc Formations

The Tax Cuts And Jobs Act An Appraisal In Imf Working Papers Volume 2018 Issue 185 2018

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Form 05 163 Download Fillable Pdf Or Fill Online Texas Franchise Tax No Tax Due Report 2018 Texas Templateroller

New Mexico Sales Tax Handbook 2022

New Zealand 2020 21 Income Tax Year Taxing Wages 2021 Oecd Ilibrary